Age of Criminal Responsibility in Australia

The age of criminal responsibility in Australia has become a pivotal issue, sparking widespread debate and calls for reform. Currently, in most Australian states, children

Sydney’s top-rated criminal defence lawyers, law firms and barristers; defending felonies, federal crimes, drug charges, fraud, financial, white collar, & criminal.

Criminal lawyers, often referred to as criminal defence lawyers, specialise in defending individuals and entities charged with criminal offences. These professionals navigate the intricacies of criminal law to ensure that their clients receive a fair trial. From minor offences like traffic violations to major crimes such as robbery or murder, proficient criminal lawyer advocates on behalf of their client, ensuring that their rights are protected and their voice is heard.

Choosing a criminal lawyer is not a decision to be made lightly. The outcome of your case can have profound implications on your life, freedom, and future.

The recommendations provided below are curated based on rigorous criteria, encompassing expertise, experience, client feedback, and professionalism. Leveraging these recommendations helps ensure that you engage with criminal lawyers renowned for their dedication, expertise, and proven track record in criminal law.

Criminal Defence Lawyers Australia® is a firm comprised of the nation’s brightest and best criminal lawyers in Sydney. With eight offices conveniently located close to the courts, they provide easy and immediate access to experienced criminal defense lawyers in Sydney. They offer free consultations and have fixed fees for criminal cases going to court. The firm is trusted by clients for its dedication and proven success, which is reflected in its high-quality legal representation and an outstanding list of awards.

The law firm includes Sydney’s top-rated criminal lawyers, who have achieved a successful track record in consistently getting serious criminal charges dropped early and achieving ‘not guilty’ verdicts in serious criminal jury trials, including section 10 (non-conviction) sentence outcomes.

Recognized as highly respected experts in criminal law, members of the firm have appeared and featured in popular television and radio talkback shows, as well as newspaper articles, for their opinions on the law. They have secured exceptional results in some of Australia’s most complex and high-profile cases over the years.

Address: Suite 279, Level 3/398 Pitt St, Sydney NSW 2000

Phone Number: 02 8606 2218

Website: criminaldefencelawyers.com.au

Sydney Criminal Lawyers is recognised as Australia’s most awarded criminal law firm, with numerous offices spread throughout the Sydney Metropolitan Area. The firm excels in handling a diverse range of criminal and traffic cases, including drink driving, drug driving, drug possession, fraud, and assault. They are renowned for their involvement in some of Australia’s most significant and complex criminal cases.

Their team comprises solicitors and barristers specialising in criminal law. This includes areas such as drink driving offences, drug offences, and white-collar crimes. Sydney Criminal Lawyers takes pride in offering their clients professional legal advice and strong representation in court. They are committed to achieving the most favourable outcomes for every case they handle.

The firm provides legal representation for individuals charged with criminal offences, as well as traffic and driving offences. They cater to a broad spectrum of clients, ranging from those aiming to avoid a conviction or clear their name to those seeking the most advantageous resolution for their case. To learn more about their services and how they can assist, potential clients are encouraged to contact Sydney Criminal Lawyers today.

Address: Museum Towers, 503/267 Castlereagh Street, Sydney NSW 2000

Phone: (02) 9261 8881

Website: sydneycriminallawyers.com.au

George Sten & Co is a specialist firm of criminal lawyers based in the central business district of Sydney, Australia. The firm was established in 1967 by George Sten and is comprised of Senior Lawyers, Paralegals and Support Staff. George Sten & Co are a one of the longest established Criminal Law Firms in Sydney. We only practice in Criminal Law and are experts in our field, our case history and results speak for themselves.

Address: Suite C4, Ground Floor 185 Elizabeth Street, Sydney NSW 2000

Phone Number: 02 961 8640

Website: criminal-lawyer.com.au

Nyman Gibson Miralis (NGM) is a criminal defence law firm based in Sydney, specialising exclusively in criminal law. Their Sydney criminal defence lawyers defend charges ranging from traffic and drug-related offences to the most serious of criminal charges, including corporate crime and sexual assault, as well as crime commission matters, including ICAC.

Address: Level 9, 299 Elizabeth Street, Sydney NSW 2000

Phone Number: 02 9264 8884

Website: ngm.com.au

AC Law Group is a respected law firm specialising in criminal law, co-founded by Deng Adut and Joseph Correy, two solicitors noted for their advocacy and activism.

Deng Adut, a former child soldier, has gained recognition as one of Australia’s best-known solicitors and was honoured as the 2017 NSW Australian of the Year. His accolades include the NSW Law Society President’s Medal and the Pride of Australia award.

Address:1/299 Elizabeth Street, Sydney NSW 2000

Phone Number: 02 8815 8167

Website: aclawgroup.com.au

LY Lawyers, a law firm boasting over 50 years of combined experience, ranks among the top criminal lawyers in Sydney and NSW, attending courts both in NSW and interstate. The firm’s lawyers bring many years of experience and exposure across various case types. LY Lawyers has a proven track record of success in handling severe criminal cases throughout Australia. They take pride in their dedication to vigorously defending and protecting the rights of their clients. Their committed lawyers provide guidance and defense in a range of matters, from complex murders and drug trafficking to more typical criminal cases.

Address: 1209/87-89 Liverpool Street, Sydney, NSW 2000

Phone Number: 02 9734 7573

Website: lylawyers.com.au

Sydney Criminal Defence & Traffic Lawyers is a firm that focuses exclusively on Criminal and Traffic Law, with their proven track record of achieving excellent results for their clients. Whether you are charged with a minor offence or a serious crime, their team of lawyers will provide you with personalised and professional legal advice, and fight for the best possible outcome in court.

Address: Level 7, 233 Castlereagh Street, Sydney NSW 2000

Phone Number: 02 8059 7121

Website: sydneycriminaldefenceandtrafficlawyers.com.au

Streeton Criminal Lawyers is a leading criminal law firm based in Sydney, Australia. The firm has a team of experienced and dedicated lawyers who specialise in defending clients charged with various criminal offences, ranging from traffic matters to serious indictable crimes. The firm’s mission is to provide high-quality legal representation and advice to clients, while protecting their rights and interests throughout the criminal justice process. Streeton Criminal Lawyers has a proven track record of achieving successful outcomes for clients, whether by negotiating favourable plea bargains, obtaining bail, securing acquittals or reducing penalties. The firm also offers free initial consultations and fixed fees for most cases, ensuring that clients receive transparent and affordable legal services.

Address:Liberty Place, Level 1, 167 Castlereagh Street, Sydney NSW 2000

Phone Number: (02) 9046 8427

Website: streetoncriminallawyers.com.au

Australian Criminal & Family Law Lawyers, a stalwart legal firm based in Sydney, New South Wales, stands as a beacon of hope for those navigating the complex waters of criminal law. Their battle-tested criminal lawyers fearlessly champion clients’ causes in courtrooms across New South Wales, from the Local Court to the High Court of Australia. With unwavering dedication and a track record of success, they’ve earned their reputation as one of Sydney’s top criminal law firms. Whether it’s defending against charges or safeguarding rights, Australian Criminal & Family Law Lawyers are the trusted allies you need.

Address: Suite 1003, Level 10, 265 Castlereagh Street, Sydney, NSW 2000

Phone Number: 1300 745 368

Website: acfl.com.au

O’Brien Criminal & Civil Solicitors, a trusted Australian law firm, remains steadfast in its pursuit of excellence. With a team of seasoned legal professionals, they provide cost-effective legal advice and representation across any state or territory of Australia. Whether defending against criminal charges, representing clients in civil claims against the police, or assisting with defamation claims against publishers, their commitment to justice is unwavering. The firm’s criminal defence lawyers fearlessly champion clients’ causes, navigating the intricacies of the legal system. From criminal appeals to advice at police stations, their recent case studies highlight successful outcomes in various criminal matters.

Address: Level 4, 219-223 Castlereagh St, Sydney NSW 2000

Phone Number: 02 9261 4281

Website: obriensolicitors.com.au

Jimmy Singh is the principal lawyer at Criminal Defence Lawyers Australia. He is highly respected amongst the profession and well recognised for his experience and proven success record on winning the seemingly un-winnable cases. He has consistently achieved outstanding results in avoiding criminal convictions whilst proving his client’s innocence in and out of court.

Learn more about Jimmy Singh

Benjamin Goh began his criminal law career in arguably the toughest legal and social environment in NSW- the Western Aboriginal Legal Service (WALS). Ben represented clients from Dubbo to Broken Hill and many remote towns in between, such as Bourke and Wilcannia. The experience Ben gained at WALS was invaluable and allowed him to appreciate the issues faced by clients from low socio-economic backgrounds who were faced with enormous stress as a result of being charged with a criminal offence.

Learn more about Benjamin Goh

Tayla has worked primarily in criminal and traffic law for her entire career. Throughout the years, she has earned a reputation for her tactful and extremely well prepared approach to every case as well as her exceptional track record of results in court.

One important aspect that sets her aside from other lawyers, is her compassion towards her clients and a drive to ensure that they receive the very best legal representation possible. Tayla understands that each case, no matter how big or small, has a profound impact on an accused person and she does not stop until every avenue is explored and every argument is made.

Learn more about Tayla Regan

Michael appears regularly as an advocate in a wide range of Local Court and Children’s Court matters, District Court sentences, appeals and bail application and Supreme Court bail applications. He has also represented clients in examinations and hearings at the NSW Crime Commission, ICAC and other investigative bodies. His approach to all matters is marked by taking time to listen very carefully to his client, attention to detail and preparation of a robust defence case.

Learn more about Michael Blair

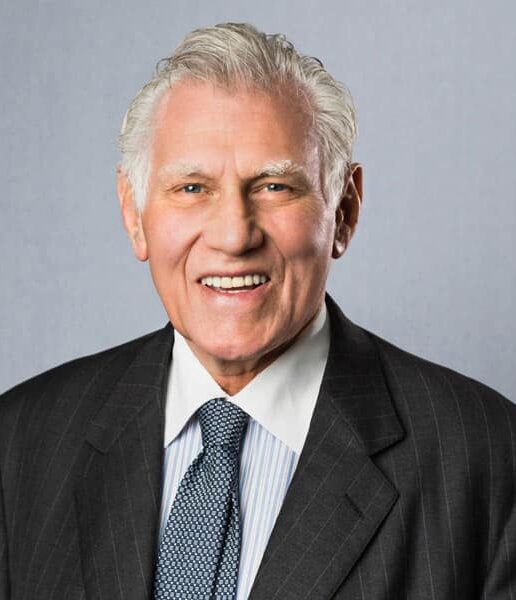

Winston Terracini is one of Australia’s most senior top criminal defence barristers specialising in criminal cases that money can buy.

Arguably, he is world renowned for his un-matched articulated skills in cross examining any kind of prosecution witness to breaking point in complex jury trials. His specialty is in winning very serious criminal cases including murder and manslaughter charges.

Learn more about Winston Terracini

Margaret Cunneen SC was a Crown Prosecutor and Deputy Senior Crown Prosecutor for many years and, before that, in the 1980’s, was an Industrial Officer at the Public Service Board of NSW. Earlier in her career she held positions in the Attorney General’s Ministerial Office and in the Parliamentary Counsel’s Office of NSW.

Margaret has extensive experience in all aspects of criminal law, having appeared in hundreds of criminal trials and appeals over 30 years.

Margaret was the Commissioner of the NSW Special Commission of Inquiry into the investigation of child sexual abuse allegations in the Catholic Diocese of Maitland-Newcastle, and handed her Report to the Governor on 30 May 2014.

Learn more about Margaret Cunneen

Richard is a leading Senior Counsel specialising in employment and constitutional law. He has been in practice at the NSW Bar since 1973 having obtained Masters Degrees from Harvard law School and Melbourne University Law School. He has been a Queens Counsel since 1984. His practice covers all areas of Public and Administrative Employment law before Superior Courts throughout Australia.

Learn more about Richard C Kenzie

Anthony Bellanto is amongst the most experienced top criminal defence barristers in Australia who has been specialising in complex criminal cases since 1976 when admitted as a barrister.

Having successfully secured not guilty verdicts in countless jury trials over the years, he is one of the most sought after barristers in Australia who has successfully represented many high profile clients.

Learn more about Anthony Bellanto

Name | Law Firm |

Australian Law Advocates | |

Criminal Defence Lawyers Australia® | |

Criminal Defence Lawyers Australia® | |

Zhai & Associates | |

Younes Espiner Lawyers | |

Armstrong Legal |

Diverse fields like family, employment, and immigration law have their own intricacies. Seek out firms solely dedicated to criminal law to ensure thorough familiarity with its complexities.

Apart from the awards a firm showcases, dig deeper:

Most criminal lawyers offer a free initial consultation. This meeting can help you gauge your comfort level with the criminal lawyer and their approach to your case. Open conversations about costs can prevent unforeseen disputes. Whether it’s legal aid, fixed fees, or a sliding scale based on the lawyer’s experience, ensure you’re clear on the financial commitment. We found that most of the firms in Sydney typically offer you a fixed fee arrangement for the type of cases you are in.

However, still, it’s best to pick criminal law firms, lawyers or barristers that have good experience and have successfully handled your type of case to ensure that you get the best possible outcome for your case.

To help you with that, we’ve done the research of going through all criminal law firms operating in the Sydney region from Law Society NSW and have put together a list below.

Meeting a criminal lawyer for the first time can be daunting, but asking the right questions can help you feel more confident and informed about your situation. Here are some key areas to cover:

The selection for the Criminal Lawyers Sydney on our website is a thorough process. We’ve hand-selected only criminal law firm that only specialises in criminal law as the main-focus of their firm.

Additionally, our process includes evaluating their educational background, years of practice, area of specialization, and case success rate.

We also give weight to client reviews and testimonials to gauge their reputation in the community.

Lastly, their contributions to the field, such as publications or speaking engagements, further influence their inclusion.

The goal is to ensure that every listed criminal lawyer upholds the highest standards of criminal law practice.

The policy regarding initial consultations varies from criminal lawyer to other criminal lawyer.

While a significant number of law firms offer free initial consultations as a way to understand your case and provide preliminary guidance, there are others who might charge a fee.

It’s essential to clarify this beforehand during submitting the website form – When reaching out to a criminal lawyer from our directory, it’s always a good practice to ask about any consultation fees.

This way, you can be prepared and make an informed decision when scheduling your appointment.

The age of criminal responsibility in Australia has become a pivotal issue, sparking widespread debate and calls for reform. Currently, in most Australian states, children

The burden of proof in criminal law refers to the obligation of the prosecution to prove the guilt of the defendant. Types of Burdens in

What is Criminal law in Australia? Criminal law in Australia is the body of law that relates to crime and regulates conduct in society to

Understanding the importance of a criminal lawyer is crucial when you’re facing criminal charges. A criminal lawyer is not just a legal representative; they are

In the intricate web of the justice system, criminal lawyers stand as pivotal figures, representing those accused of crimes and navigating through the complex legal

Becoming a criminal lawyer in Sydney is a challenging yet rewarding journey. This career path involves dedicated education, practical training, and a commitment to upholding

How much does a criminal lawyer cost?

What kind of criminal lawyer do I need?

What does a criminal lawyer do?

Why do you need a Criminal Lawyer